50-Year Mortgages Are Arriving in Michigan and Buyers Are Not Prepared

- Knybel Network - Real Estate

- Dec 10, 2025

- 6 min read

Updated: Dec 15, 2025

Michigan’s Housing Market is Shifting and Most Buyers Are Not Ready

A major change is entering Michigan real estate. The introduction of 50-year mortgages and “no credit score” loans is already reshaping affordability, risk, and long-term financial outcomes for buyers. These programs are marketed as solutions for families struggling with home prices, interest rates, and lending restrictions. The truth is more complicated. Buyers in Macomb County, Metro Detroit, Oakland County, St. Clair County, and surrounding regions need to understand what these loans actually mean before they commit.

This guide breaks down what lenders are offering, the benefits that sound helpful, the long-term consequences that most families overlook, and the questions every buyer should ask before choosing a mortgage that may take half a century to pay off.

Why Lenders Are Promoting 50-Year Mortgage Terms

Michigan Buyers Need Lower Payments and Lenders Are Responding

Interest rates have increased in recent years. Home prices across Michigan have remained elevated. As a result, monthly payments have become a significant barrier for first-time buyers. Extending the mortgage period from 30 years to 40 or 50 years reduces the monthly payment. More buyers qualify. More loans close. More transactions move forward.

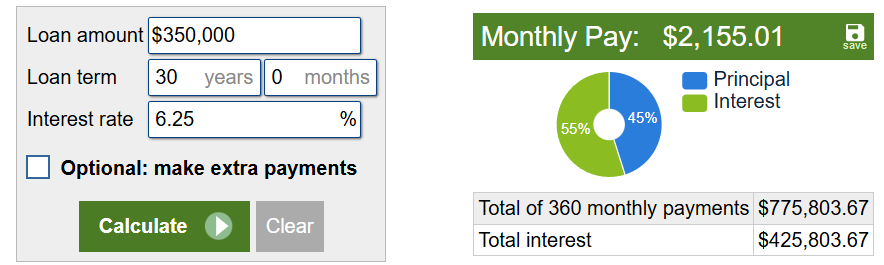

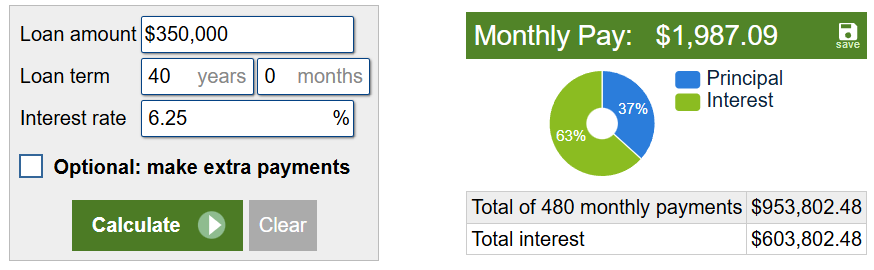

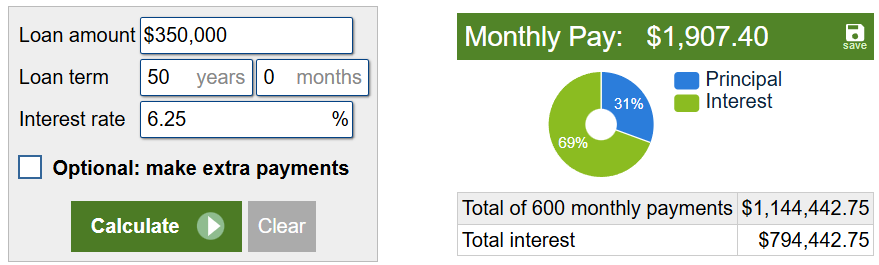

But a lower monthly payment does not mean a cheaper long-term cost. The total interest paid on a 50-year mortgage is dramatically higher. A $350,000 home can easily become an extra $500,000+ obligation over the full life of the loan.

“A 50-year mortgage is not more affordable. It is simply more stretched out.”

Banks Are Preparing for a New Mortgage Environment

Home prices are not dropping quickly. Rate cuts will not fix affordability. Inventory remains limited. Lenders want a way to approve buyers without loosening federal guidelines. Longer mortgage terms allow them to qualify buyers by stretching payment timelines, not by improving affordability.

What “No Credit Score Loans” Actually Mean in Michigan

These Loans Do Not Ignore Credit They Simply Measure It Differently

A “no credit score” loan does not mean credit is irrelevant. Instead, lenders rely on alternative evaluation models that study rental history, on time utility payments, income stability, bank statement patterns, and job consistency.

These programs can help buyers with limited credit history, past medical collections, or thin credit files. However, many of these loans include higher interest rates or additional insurance requirements. They offer opportunity, but not without cost.

Approval Does Not Mean You Can Comfortably Afford the House

Many Michigan buyers confuse the ability to qualify with the ability to afford long-term. “No credit score” loans may reduce barriers, but they can also lead buyers into homes that strain budgets once taxes, insurance, interest, and maintenance start climbing.

“Approval does not equal affordability, especially in Michigan’s shifting market.”

The Pros and Cons of 50-Year Mortgages for Michigan Buyers

Potential Benefits That Look Attractive at First

A 50-year mortgage can provide:

Lower monthly payments

Easier qualification

A smoother debt-to-income ratio

Expanded access for young families or first-time buyers

For renters watching prices rise fast, these loans may feel like the first real chance to enter the market.

“Most buyers underestimate how long 50 years actually is.”

Long-Term Costs That Can Hurt Michigan Families

The downsides become clearer over time. Interest costs are significantly higher. Equity builds slowly. Buyers stay underwater longer. Market shifts create higher risk. Homeowners become tied to a property far longer than intended. A 50-year mortgage can feel helpful now but become a long-term financial burden.

How 50-Year Mortgages May Influence Michigan Home Values

Increased Buying Power Often Leads to Higher Prices

When buyers suddenly gain more purchasing power because their payments shrink, sellers respond. Home prices rise. Competition increases. Buyers with traditional 30-year loans may struggle to compete. If 50-year mortgages become common across Michigan, especially in Metro Detroit and surrounding counties, price inflation is likely.

Equity Growth Will Lag Behind Appreciation

While values may continue climbing, buyers on a 50-year mortgage will not build equity quickly. The early years of the loan contribute little to principal reduction. Homeowners may struggle to refinance or move within the first five to ten years.

Key Warnings Michigan Buyers Should Understand Before Signing

Warning 1 🔥 Do Not Focus Only on the Monthly Payment

A lower monthly payment does not guarantee a better mortgage. Michigan buyers must evaluate the total interest paid, early amortization schedule, and long-term financial impact. The true cost of the home may be far higher than expected.

“The biggest danger of extended loans is not the payment. It is the interest.”

Warning 2 🔥 Think About Your Life Decades From Now

A 50-year mortgage reaches into your 70s or beyond. Buyers must consider career paths, retirement plans, aging, mobility, health, and future family needs. A mortgage that lasts half a century binds your future in ways most buyers have never considered.

Warning 3🔥 Never Sign a Loan You Cannot Explain

If you cannot clearly explain how the interest works, when equity grows, what the refinance options look like, or how rising taxes and maintenance will affect you, the loan is not safe. Understanding the terms is essential before committing.

How Michigan Buyers Should Evaluate These New Mortgage Options

Step 1: Compare 30-Year, 40-Year, and 50-Year Costs Side by Side

Michigan buyers should review total interest paid, not just immediate affordability. The “lowest payment” loan may cost the most money overall. This comparison should be part of every mortgage consultation.

Step 2: Work With a Realtor Who Understands Financing

Not all agents understand amortization schedules or long-term financial modeling. Buyers need guidance from someone who can explain how mortgage structures influence resale, equity, and long-term affordability. You help families make informed decisions that match their goals and budgets.

Step 3: Consider Local Market Dynamics in Your County

Macomb County moves differently than Oakland County. St. Clair and Lapeer have slower cycles than Metro Detroit. Sanilac County behaves differently than fast-appreciating suburbs. Each market reacts uniquely to mortgage changes. Understanding local conditions is essential.

Final Thoughts 50-Year Mortgages Are Tools, Not Solutions

A 50-year mortgage or no credit score loan is not inherently harmful. It becomes dangerous when buyers accept it without understanding the consequences. Michigan families deserve transparency. They deserve guidance. They deserve to know how a loan will shape their financial life decades into the future.

Before you commit to a loan that may follow you for the rest of your working life, talk to someone who understands the full picture.

Frequently Asked Questions (Michigan Buyers and 50-Year Mortgages)

Are 50-year mortgages available in Michigan right now?

Some lenders have already begun offering extended amortization options, including 40-year and 50-year terms, often through specialty loan programs or debt restructuring channels. Availability varies, but the trend is growing and is expected to expand across Michigan as affordability challenges continue.

Who benefits the most from a 50-year mortgage?

Buyers who need lower monthly payments, buyers with limited credit history, and first-time homebuyers struggling with affordability may benefit. However, these advantages come with long-term financial trade-offs that must be evaluated carefully.

What is the biggest risk of a 50-year mortgage?

The primary risk is the massive amount of interest paid over the life of the loan. It often totals hundreds of thousands of dollars more than a traditional 30-year mortgage. Equity also builds extremely slowly, creating long-term financial vulnerability.

Do “no credit score loans” ignore bad credit?

No. These loans do not ignore credit history. Instead, they rely on alternative documentation like rental payment history, income stability, utility payments, and bank statements. Buyers must still meet affordability and risk standards.

Will 50-year mortgages increase home prices in Michigan?

Yes. As buyers gain more purchasing power through lower monthly payments, sellers adjust prices upward. If 50-year loans become broadly accepted, starter-home competition will increase, which can raise home values across Metro Detroit and surrounding counties.

Is a 50-year mortgage a safe idea for first-time buyers?

It depends on income stability, long-term plans, financial discipline, and how well the buyer understands total interest costs. Some families may benefit; others may become overextended. Professional guidance is essential.

How should Michigan buyers decide between a 30-year and 50-year mortgage?

Buyers should compare total interest, amortization schedules, equity growth, future mobility, and long-term financial goals. Payment size alone should never be the deciding factor.

What counties in Michigan are most affected by these loan changes?

Macomb County, Oakland County, St. Clair County, Lapeer County, and Sanilac County all have rising home prices and limited inventory. These areas may see increased 50-year mortgage adoption as buyers struggle to qualify under traditional loan terms.

Who can help me understand whether a 50-year mortgage is right for me?

You can reach out directly for personalized guidance on Michigan lending trends, mortgage structures, affordability planning, and long-term ownership strategy.

Email: Office@KnybelNetwork.com

Phone: 586-295-9550

Website: www.KnybelNetwork.com

Contact Information for Michigan Buyers Seeking Guidance

📧 Email: Office@KnybelNetwork.com

📱 Call/Text: 586-295-9550

🌐 Website: https://www.KnybelNetwork.com

Serving families across Macomb County, Oakland County, St. Clair County, Lapeer County, Sanilac County, and Metro Detroit.

Comments